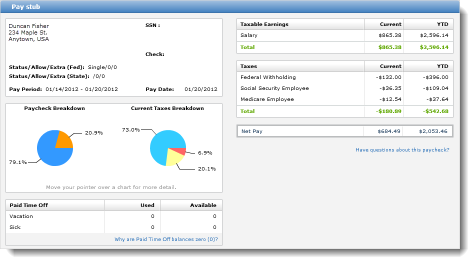

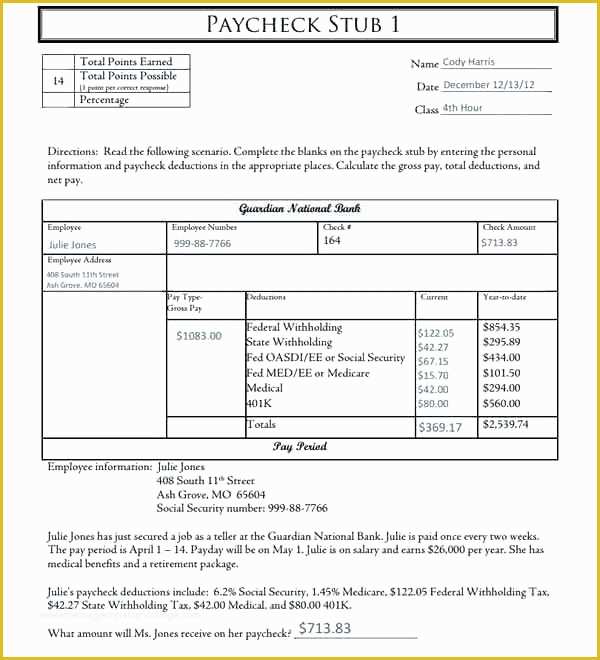

Employers use stubs as due diligence as proof that employees are aware of payment deductions.Paycheck stubs are used for tax filing purposes.Through the pay stubs, you’ll get to know what deductions apply to you.

This is particularly important when you are starting a new job. It’s therefore recommended that an employee gets into the habit of reviewing their pay stubs each time they get paid.

In addition, it shows the total YTD (year-to-date earnings). This fact notwithstanding, stubs give the employees key insights into their gross pay and outline what deductions are taken out of their checks each pay period.

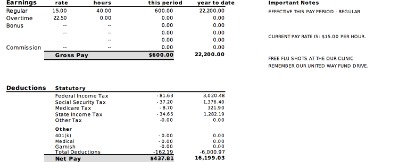

This is presented as PDF file Decrypted by the only password which ultimately helps in preserving the format as well as the layout of the pay stubs.Employers and employees will have different preferred payment methods from one workplace to the other. You have the choice to email the pay-stubs to the employees by utilizing QuickBooks Desktop.

When we print pay stubs on a void paper, the company name, address and phone number will appear on the bottom and top of the page. QuickBooks Desktop uses a template or default layout with the format but then font cannot be changed. QuickBooks Desktop provides us to use a plain white paper to print a pay stub.

0 kommentar(er)

0 kommentar(er)